For enterprises, organizations, and SaaS platforms looking to expand into new markets, introduce diverse payment methods, and enhance customer experiences, relying on a single Payment Service Provider (PSP) can be limiting.

A one-size-fits-all PSP model may suffice initially, but as organizations scale, the need for multiple PSP relationships becomes essential to:

- Support multiple geographies with region-specific payment options.

- Ensure omnichannel payment acceptance across e-commerce, mobile, and in-store environments.

- Optimize transaction costs by leveraging the most cost-effective PSPs for different scenarios.

- Introduce innovative payment experiences, such as pay-by-link or tap-on-mobile.

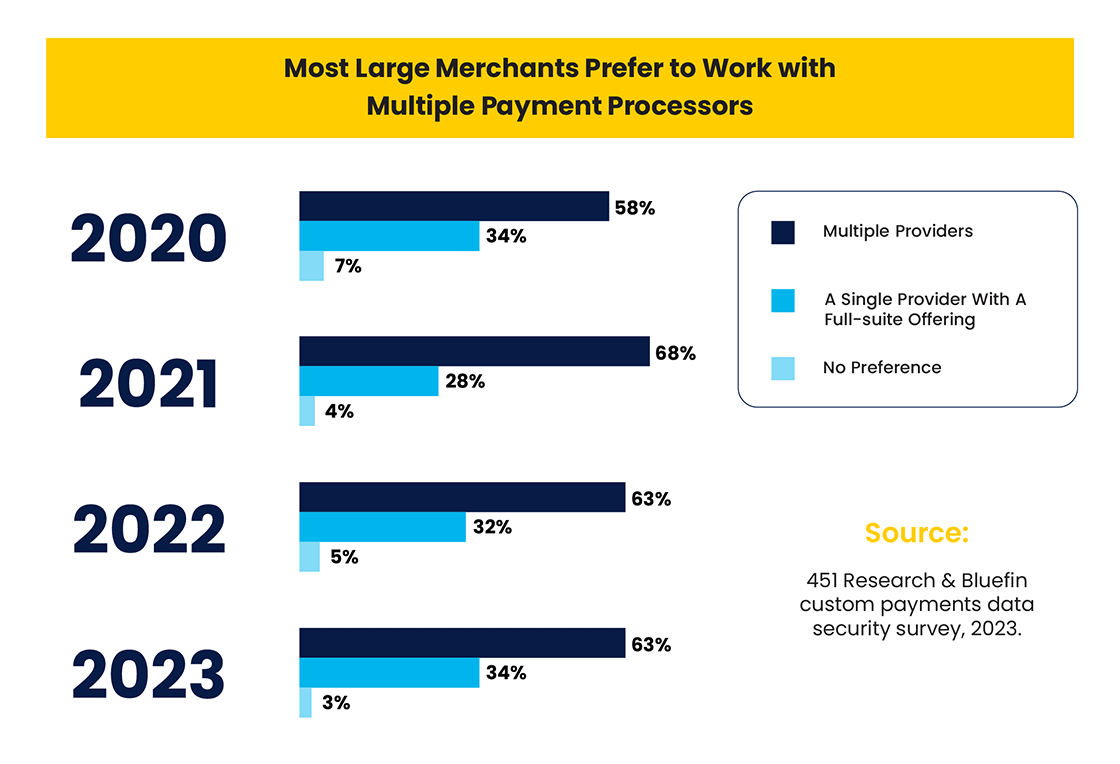

As reported in Bluefin and 451 Research’s white paper, The Strategic Importance of Payments Data Ownership, this demand for flexibility is evident – nearly two-thirds (63%) of merchants with over 1,000 employees prefer using multiple processors, citing better geographic reach and cost efficiency as key factors.

Reclaiming Control:

The Need for PSP-Agnostic Tokenization

While expanding PSP relationships is crucial, businesses must also consider how they manage their payments data. Traditional PSP-driven tokenization, while aiding PCI DSS compliance, often locks businesses into a single provider, limiting agility and increasing switching costs. This dependency on PSPs for data security can create significant operational risks.

To overcome these challenges, businesses need a decoupling strategy – one that grants them full control over their payments data. This begins with a PSP-agnostic tokenization approach, where businesses can retain ownership of their transaction data without being tied to a single provider.

Exploring the Alternatives:

In-House Vaulting vs. Third-Party Tokenization

To break free from PSP lock-in, businesses typically have two main options:

- Building an in-house card data management infrastructure

- Requires compliance with PCI DSS certifications.

- Demands significant operational and security investments.

- Poses risks associated with internal storage of sensitive payment data.

- Only 21% of businesses today feel “very confident” in their ability to protect customer payment data, as highlighted by 451 Research and Bluefin surveys.

- Leveraging a third-party tokenization provider

- Offloads compliance and security burdens while maintaining data ownership.

- Ensures portability and accessibility of payment data across multiple PSPs.

- Eliminates costly and complex data migrations when switching providers.

For most enterprises, organizations, and SaaS platforms, an independent tokenization provider offers the best balance between security, compliance, and flexibility. By using a third-party tokenization service, businesses can tokenize payment data in a PSP-agnostic manner, ensuring control without sacrificing convenience.

The Path to Greater Payments Autonomy

As the payments landscape continues to evolve, businesses must rethink their PSP strategies. A multi-PSP approach, combined with PSP-agnostic tokenization, empowers companies to:

- Enhance market expansion efforts without PSP constraints.

- Reduce dependency risks and improve redundancy.

- Optimize payment processing costs and improve transaction success rates.

- Maintain full ownership of customer payment data, ensuring long-term agility.

By embracing these strategies, enterprises, organizations, and SaaS platforms can future-proof their payment operations and position themselves for sustained success in an increasingly dynamic digital economy.

Learn More About ShieldConex Orchestration

ShieldConex® Orchestration provides a comprehensive, PSP-agnostic tokenization solution that enables businesses to take control of their payments data while ensuring seamless security and compliance. Discover how ShieldConex can help you unlock payments autonomy.